How To Generate And Utilize Extra Cash Flow

Posted by JD Esajian // July 6, 2016

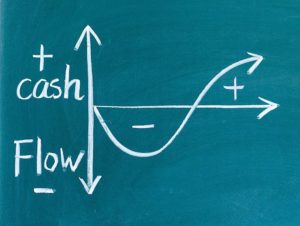

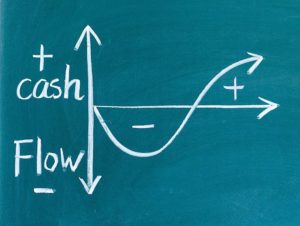

Cash flow is the name of the game for most rental property owners. The greater the amount of monthly cash flow the more attractive the property is. On the surface calculating cash flow is as easy as subtracting your expenses from the income received. This wouldn’t be a wrong calculation but there is often much more that goes into it. By squeezing even an extra 5% to your monthly bottom line it can greatly impact your business. Here are three ways you can generate extra cash flow and a few suggestions for what you should do what that extra income.

GENERATING CASH FLOW:

- Evaluate expenses. With every rental property that you own you need to treat it like its own separate business. This means staying on top of all expenses. As surprising as it sounds a good number of landlords are not aware of where their money goes every month. They know the big expenses, like property management, but do not know the smaller ones. It is these smaller expenses that quickly add up and reduce your bottom line. Every few months you need to take a day and look at all of your expenses. You may be surprised at just how high the water/sewer bill is or how much lawn maintenance is. Look for expenses that you can reduce, pass on to your tenants or even eliminate all together. Increasing cash flow has to start with a full breakdown of your expenses.

- Quality Work/Appliances. If your plan is to own the property for as long as possible you need to look at the big picture. Every time an appliance needs to be repaired or replaced it is not enough to simply put a band aid on it to get you through the lease. This may help in the short term but eventually will come back to bite you. By hiring people that deliver quality work and using reliable appliances you will not have to worry about the issues coming back. Instead of having to fix the dishwasher ever few years a new model will eliminate this problem. Doing this will help you avoid having to dip into your reserves and keep your cash flow as high as possible.

- Good Tenants. Cash flow is the cycle of money that is generated from the property. The major clog in this cycle is tenants that pay every month. The minute they stop paying everything comes to a halt. It is critical to spend extra time screening your tenants until you are comfortable. Squeezing extra cash out of your tenants is a novel thought but you need to know where to draw the line. An extra $25 or $50 a month probably won’t have a major impact on you but could push your tenant over their threshold. Focusing on better tenants at fair rent prices allows you to always take steps forward without having to deal with a vacancy.

HOW TO UTILIZE ADDITIONAL CASH FLOW:

- Pay Down Loan. Generating cash flow just for cash flow sake is not the goal. What you do with these extra funds will often define your business. If you use them for personal use you will open the door for trouble. At difficult as it may be at times you need to keep any extra cash flow inside your business. The first thing you should consider is paying down any loan balance you have. By adding just a few hundred dollars to the principal every month you can knock years off your mortgage. Not only will you accelerate how quickly you can own the property free and clear but you are adding equity. This equity will give you options if you decide to sell or refinance at some point down the road.

- Pay Down Debt. The next item you should look at is paying down any debt. High balances on credit cards and other revolving debt is one of the silent credit score killers. You can pay everything on time but if your balances are high your score will be higher than you think. Paying down debt is not only necessary for your credit score but for your monthly bottom line. Instead of paying double digit monthly interest rates for a credit card you can focus on paying it off. By using cash flow to reduce your business overhead your business is stronger and allows you to pursue more deals.

- Savings/Reinvest. There are many debates as to whether you should use extra cash to pay down debt or reinvest. Like most everything else in real estate the answer is that it depends on the individual situation. What cannot be argued is that you should always make your money work for you. If you have reduced your loan balance and debt you can look for attractive savings vehicles. Even though most of these options are rather unattractive you should consider them a weigh station to use on your next deal. Saving up cash flow for your next deal may seem like climbing an uphill battle but you need to start somewhere. With a $200 monthly surplus you can hit over five figures sometime over four years. This may help get a wholesale deal that you can double your money on or a piece of a deal with a business partner. You won’t accumulate this money overnight but you need to start somewhere.

It is not how much cash flow you generate but what you do with it. You should have a plan of attack for how you will use it every month. If not you could find yourself in a few years wondering just where all the surplus went.